Making an Employee a Leaver

AN EMPLOYEE SHOULD ONLY BE MADE A LEAVER AFTER THEIR FINAL PAY RUN IS COMPLETED.

LEAVER PAY RUNS SHOULD BE DOWN IN SEPARATE PAY RUNS

HOLIDAYS REMAINING CAN BE A NEGATIVE, IN THIS CASE THEY SHOULD BE A DEDUCTION - EXACTLY THE SAME PROCESS, EXCEPT NEGATIVE HOURS

FOR 2022 LEAVERS AN ADDITIONAL 55.3HOURS MUST BE DEDUCTED OFF THE ALLOWANCE

Steps to ending an employee's employment in Xero...

- Calculate the number of holidays an Employee has left

- Ask Richard or Robert about any outstanding deductions an employee has

- Do a Pay Run for only the leaver

- When doing the Pay Run add the

- End the employee's employment

- Generate the employee's P45

Calculate the number of holidays an employee has left

Steps...

- Use GOV website use the calculator to find out the number of holidays the employee is due for the period they have worked of the holiday year

- Total the holidays an employee has used in the holiday year

- Deduct the total holidays from the remaining holiday allowance

Use GOV website use the calculator to find out the number of holidays the employee is due for the period they have worked of the holiday year

Using the calculator at Calculate holiday entitlement - GOV.UK (www.gov.uk) enter the following information

- Year Start Date - This is always the first of January

- Employee Start Date (if within this holiday year)

- Employee Leave Date

- Employee Hours Per Week

- Employee Days Per Week

The calculator will tell you the number of hours the employee is entitled to.

Total the holidays an employee has used in the holiday year

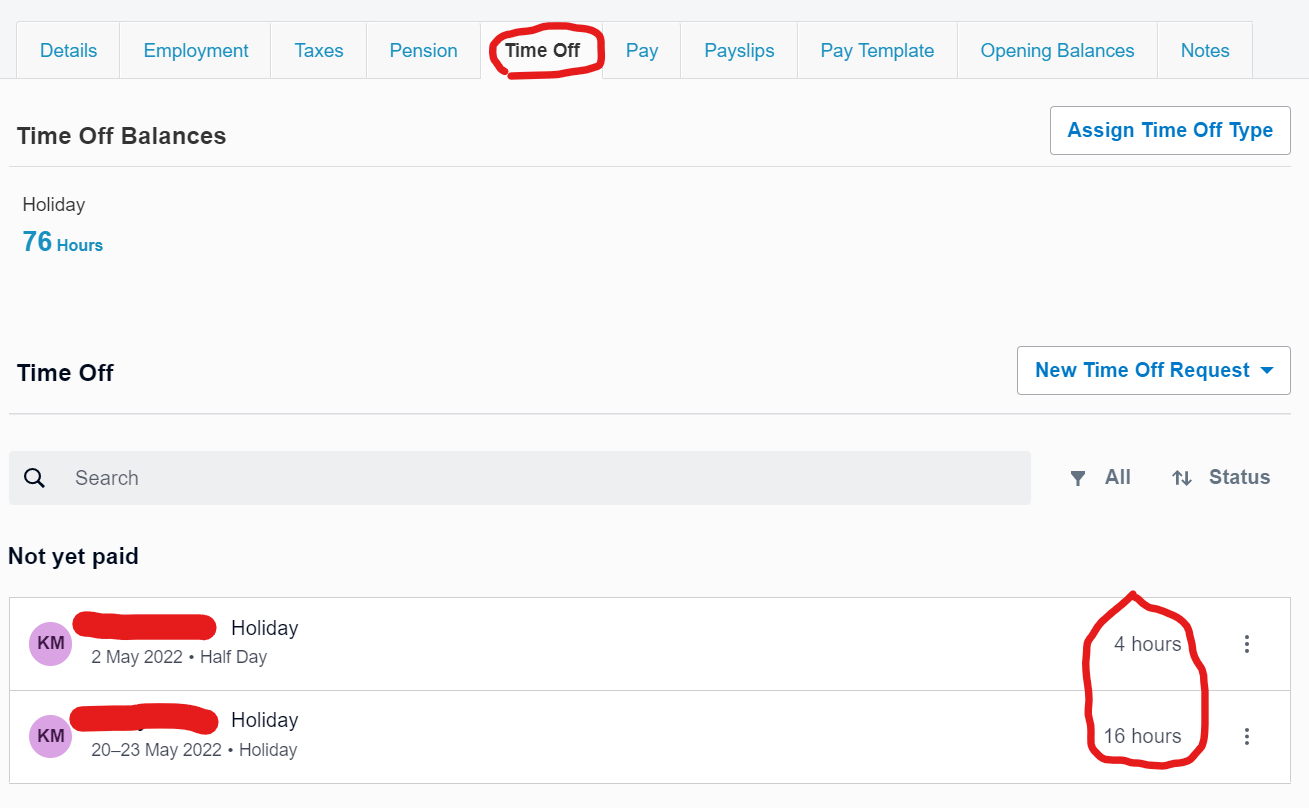

Total any holidays the employee has had in this from the entitled to calculation. You can get a total calculation from the employee's screen and the "Time Off" section.

- Add up all the hours in the time off section up to the point of the employee's end date.

- In the example below the employee has had 20 hours total paid Holiday

(In this example the employee's last date is the 1st of June 2022)

Remember to add on business holidays to this amount, they are not automatically added to this list

Deduct the total holidays from the remaining holiday allowance

Equation to be used: Total remaining holidays to be paid = Remaining allowance = holidays used

Example in use

Leaver started in 2011, leaving on the 1st of June 2022.

| Leaver Start Date | 01/02/2011 |

| Leaver End Date | 01/05/2022 |

| Holiday Allowance (Using Calculator) | 93.3 |

| Holidays Allowance Used | 20 |

| Business Holidays Used | 16 |

| Total Allowance Used | 36 |

| Holidays Remaining | 57.3 = round up to nearest hour = 58 |

End the employee's employment

After finishing the

No Comments