Creating a Stock Accrual

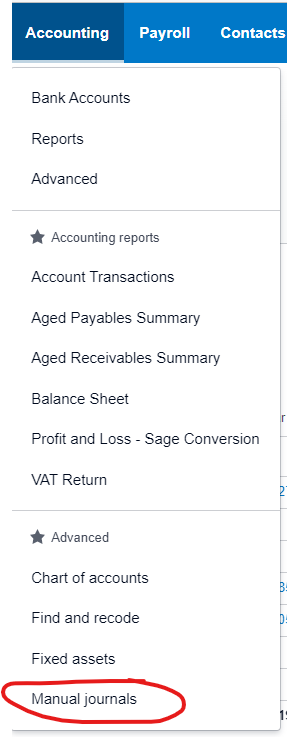

You must have permissions to Manual Journals to make Stock Accruals

Stock Accruals are generated from the Stock Management Spreadsheet on the shared business one drive. Link here:

https://1drv.ms/x/s!AgZhmG8o-Mafge0h9LG0mwqB-cdJBw?e=XN8Msx

Stockheld Stocks

We stockhold the following stocks

| Stock | Supplier |

| Banner | Soyang/Innotech/Europoint/Vink |

| Mesh | Soyang/Innotech |

| 3mm PVC (8x4) | Antalis/Europoint/Perspex |

| 5mm PVC (8x4) | Antalis/Europoint/Perspex |

| ACM 0.10 Skin (8x4) | Antalis/Perspex/Vink |

| ACM 0.12 Skin (10x5) | Antalis/Perspex/Vink |

| Quickfire 800mm Roll Ups | Very/Innotech/Plex/Easy Stands |

| 3.5mm Fluted Board (Correx) | Antalis/Europoint |

| Vinyl | Antalis/Europoint/Perspex |

Stock Count Sheet

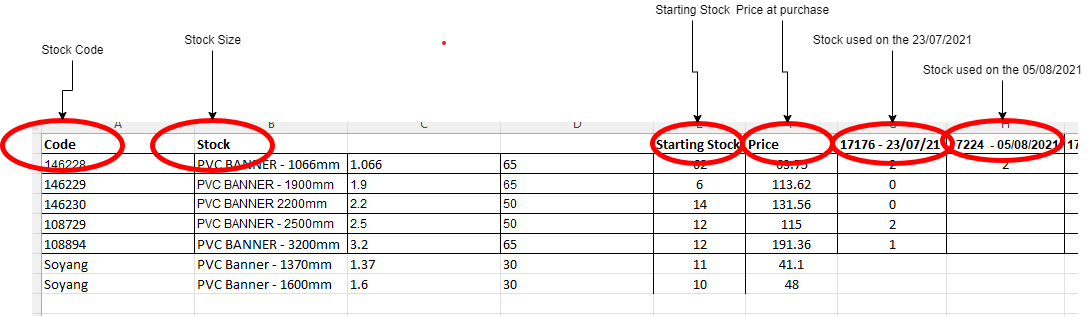

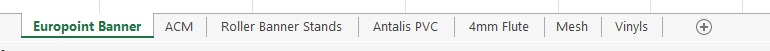

The excel document contains the following spreadsheets...

One for each stock type.

Spreadsheet Format

On each spreadsheet you will find...

- List of stock sizes

- Supplier codes

- Price at purchase

- Starting Stock Count

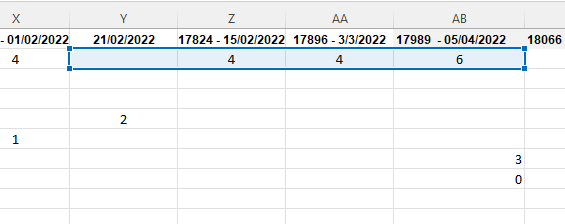

- For each withdrawal date from stock the amount of stock taken

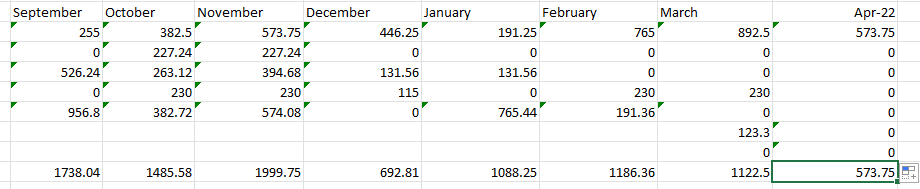

- A breakdown of the total amount of stock used per month

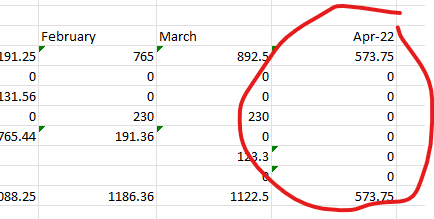

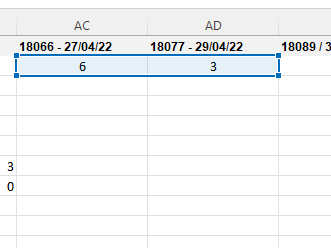

1. Calculate the Months Usage

- Update the Stock Management Totals Section

- Find out the last period that the stock ran too

- Add an extra month to the Stock Management Totals Section

- Update the copied formula to select this months dates

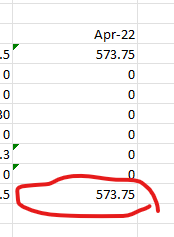

- Use this total as your accrual value

2. From the Accounting Menu > Manual Journals

3. Select New Journal

3. The Narration is so you can quickly see the content of the journal, think of it like the invoice number

3.2 For Stock Accruals the Journal Narration Should be STOCK OUT/IN - MONTH

e.g. STOCK OUT - April

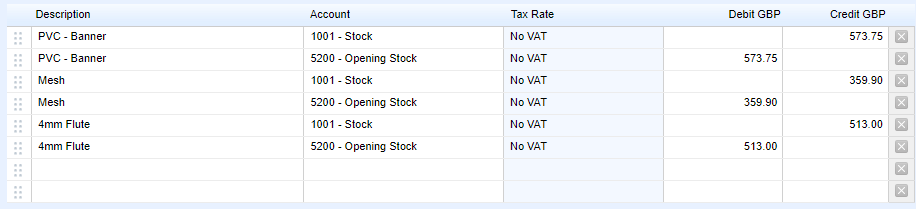

4. Enter the lines of the Manual Journal

If you are accruing for Sales Invoices, you should also accrue for the Stock and Supplier Costs as Bill Accruals

For Stock In

For Stock In there should be two lines for each stock, one Credit to Nominal Code 5200 - Opening Stock and one Debit to Nominal Code 1001. The credit amount should be the total amount of stock that is to be held.

For Stock Out

For Stock In there should be two lines for each stock, one Debit to Nominal Code 5200 - Opening Stock and one Credit to Nominal Code 1001. The credit amount should be the total amount of stock used in the month.

5. Select the Date

You should select the date you want the accrual to appear in. e.g. If you are accruing an April Stock it would be 30/04/2022

6. Do not Select a Reversing Date

For Stock accruals you do not select a reversing date.

No Comments