Credit Application Procedure

Overview

This overviews the process for credit applications data collection, approval and rejection. Including the workflow, documentation, tracking and communication templates.

Current Credit Controllers

| Robert McCombe | robert@maticmedia.co.uk |

| Richard McCombe | richard@maticmedia.co.uk |

Credit Application Document

Current credit application form is available below.

Credit Application Form_2016V1.docx

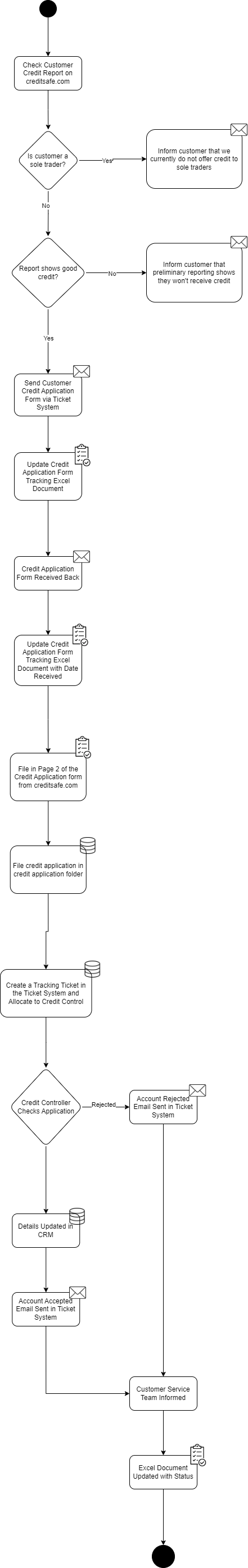

Process & Workflow

Application Tracking

Steps

CreditSafe.com

Creditsafe is a third party credit controller that tracks payment performance of companies and can provide access to credit reports on individuals as well. Currently we pay for access to company credit reports only.

It can be difficult to get credit reports on sole traders as such as do not accept credit applications from sole traders.

| URL | www.creditsafe.com |

| Username: | Available in Vault |

| Password: | Available in Vault |

Filling in Page 2 of the Credit Application

Page 2 of the credit application contains all the information required to approve or decline a credit account. Failure on your part to fill in this information will slow down your customers credit approval process.

if a customer has scanned their credit application and you cannot fill in the information. You can fill it in using the Tracking Excel Document, and by copying & pasting the below form in to the tracking ticket.

|

Date CA Sent |

|

Score |

|

|

Date CA Received |

|

Credit Limit |

£ |

|

Latest Annual Return (Year) |

|

Credit Rating |

£ |

|

Payment Performance |

|

Working Capital |

£ |

|

Days Beyond Terms: |

|

Total Current Assets |

£ |

|

Adverse: CCJ’s |

Y/N |

Total Current Liabilities |

£ |

|

Credit requested: |

£ |

Long Term Liabilities |

£ |

|

Change in Score history over the past 12 months Y/N | ____% |

Y/N |

Total Net Worth |

£ |

|

Acid Ratio: |

|

|

|

|

Notes |

|

|

|

Processed By |

|

|

Date |

|

|

Amount Authorised |

|

|

Terms (Days) |

|

|

Signature |

|

Creating a Tracking Ticket for the Application

If the current application is not in a ticket, create a ticket in Zammad and attached the filled in created application form. Then assigned this ticket on to the Credit Controller.

Filling in the Application Tracking Excel Document

The Application Tracking Excel Document is available here: Credit Application Tracking v3.xlsx or it is available in the Matic Media One Drive shared folder "Credit Control" under Shared with Everyone.

The credit application form should be filed in the folder Matic Media One Drive/Shared with Everyone/Credit Control

Fields

| Field | Description | Example |

| Customer | The Company Name | Matic Media |

| Date Sent | Date Application Sent | 2023-03-03 |

| Ticket URL | The Ticket url for tracking communication in regards to the application | https://cs.maticmedia.co.uk/#ticket/zoom/245289 |

| Page 2 Form Completed? | Where the page two form data is etiher in the application or in the ticket | In ticket |

| Sent By | The person who sent the application | Robert McCombe |

| Date Received Back | The date the application was received back | 2023-03-05 |

| Passed to Credit Controller | The date the application was sent to the credit controller for approval | 2023-03-06 |

| Date Processed | The date the credit controller approved or rejected the credit application | 2023-03-07 |

| Time to Process | The total application time | 2 Working Days |

| Requested Limit | The amount the account requested | £2000 |

| Approved Limit | The amount the credit controller has approved | £1500 |

| Approved or Rejected | Whether the credit account was approved or rejected | Approved |

| Credit Controller | The credit controller | Robert McCombe |

| Payment Terms | The payment terms | 30 Days End of Month |

| Customer Informed Email Sent | Date the credit controller informed the customer | 2023-03-07 |

| Date application completed | The date the application was completed and filed | 2023-03-07 |

Decision Making on a Credit Application

| Positive Factors | Negative Factors |

| Good Score (Above 50>) | Low Score (< 50) |

| Increase or stable Score History | Decreasing Score History |

| ACID ratio above 1 | CCJ's |

| ACID Ratio Below 1 | |

| Change of Directors | |

| Last accounts filed > 12 months | |

|

Increasing Liabilities vs Current Assets |

|

|

Decreasing Current Assets |

|

|

Decreasing Shareholder Funds |

|

|

Decreasing Net Worth |

Amount of credit given is generally based on the recommended Credit Limit given by CreditSafe, Terms are based on the size of the company. Default is 30 days on date of invoice.

Communication Templates

Sole Trader Rejection

Hi [forename],

Thank you for your request for a credit account with us. Unfortunately at this moment in time we have decided to not accept account applications from sole traders. If your status should change in the future please feel free to apply again and we can review your credit application.

Regards,

Credit Controller

Matic Media Services Limted t/a Graphic Warehouse

9 Hagmill Road

Coatbridge

ML5 4XD

United Kingdom

p: +44 (0) 330 380 0172

e: accounts@graphicwarehouse.co.uk

Preliminary Application Rejection

Hi [forename],

We've had a preliminary look over your accounts with company number [company number] and currently unfortunately a preliminary report shows your account will not be approved for credit. If this is the wrong company number, please fill in the attached credit application and we'll process your account through our formal credit application process.

If this is the correct company number please feel free to apply for a credit account again in the next 90 days if you believe your credit status has changed.Regards,

Credit Controller

Matic Media Services Limted t/a Graphic Warehouse

9 Hagmill Road

Coatbridge

ML5 4XD

United Kingdom

p: +44 (0) 330 380 0172

e: accounts@graphicwarehouse.co.uk

Credit Application Received Template

Hi [forename],

Thank you for your completed credit application. I have processed this into our credit application process. Please expect a response within 5 working days from our Credit Controller.

Regards,

Credit Controller

Matic Media Services Limted t/a Graphic Warehouse

9 Hagmill Road

Coatbridge

ML5 4XD

United Kingdom

p: +44 (0) 330 380 0172

e: accounts@graphicwarehouse.co.uk

Credit Application Rejected Template

Hi [forename],

Unfortunately your account has not been approved for credit with us. Please feel free to apply for a credit account again in the next 90 days if you believe your credit status has changed. If you would like more details on why your credit account has not been accepted please feel free to respond to this email.

Regards,

Credit Controller

Matic Media Services Limted t/a Graphic Warehouse

9 Hagmill Road

Coatbridge

ML5 4XD

United Kingdom

p: +44 (0) 330 380 0172

e: accounts@graphicwarehouse.co.uk

Credit Application Approved Template

Hi [forename],

Your account has been accepted for credit with us with the following terms...

Account ID: [Account ID from Xero] Total Credit: £????.?? Payment Terms: 30 Days End of Month

30 Days from Invoice DateInvoices will be sent to: [accounts email address] Your credit account has been applied to your online account available at www.graphicwarehouse.co.uk immediately. You can see your current outstanding invoices and get copy invoices from your online account immediately.

Regards,

Credit Controller

Matic Media Services Limted t/a Graphic Warehouse

9 Hagmill Road

Coatbridge

ML5 4XD

United Kingdom

p: +44 (0) 330 380 0172

e: accounts@graphicwarehouse.co.uk

Key Performance Indicators

The following metrics are used to track performance of the credit application procedure.

| Metric | Description | Target |

| Process Time | The time from which a completed credit application is received till is has been submitted to the credit controller. | 2 Working Days from filled Application Received |

| Application Approval Time | The time from which a processed application is approved or rejected when submitted to the credit controller. | 5 Working Days from Application Processing |

Reading a Credit Report

Company Number

This is a customers unique number recorded with Companies House, it is a better identifier of company as some companies can trade as a different name from their registered name.

We are a good example of this - Trading Name is Graphic Warehouse, Entity name is Matic Media Services Limited.

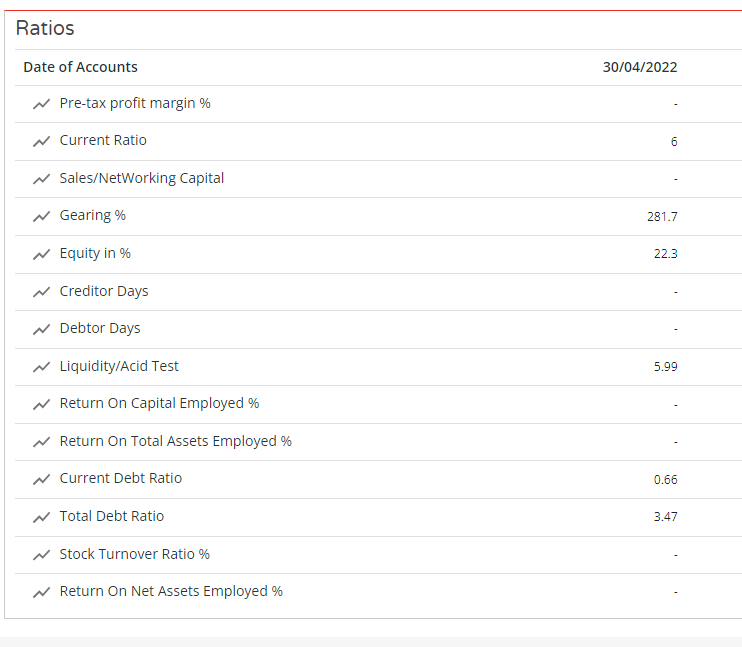

Risk Score

This is the customer's credit score out of 100, it takes all the factors below and generates a score out of 100 based on how much of a risk they are. 50 is the average.

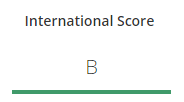

International Score

This is the same as above but on a international scale. This is graded A to F with AAA being excellent and F being inactive.

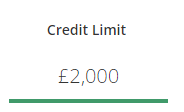

Credit Limit

This is the max amount of money recommended for a credit account to risk.

Contract Limit

This is the max amount of money recommend on an individual contract basis.

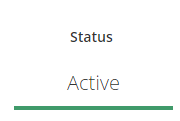

Status

This is the current status of the business...

| Active | Currently active |

| Inactive | Currently not trading |

| Administration | Currently in administration |

DBT - Days Beyond Term

This is how many days beyond terms the customer pays beyond.

Industry DBT - Industry Days Beyond Term

This is the industry standard for the customer e.g. if the customer is in construction what is the average days beyond term a construction company takes to pay.

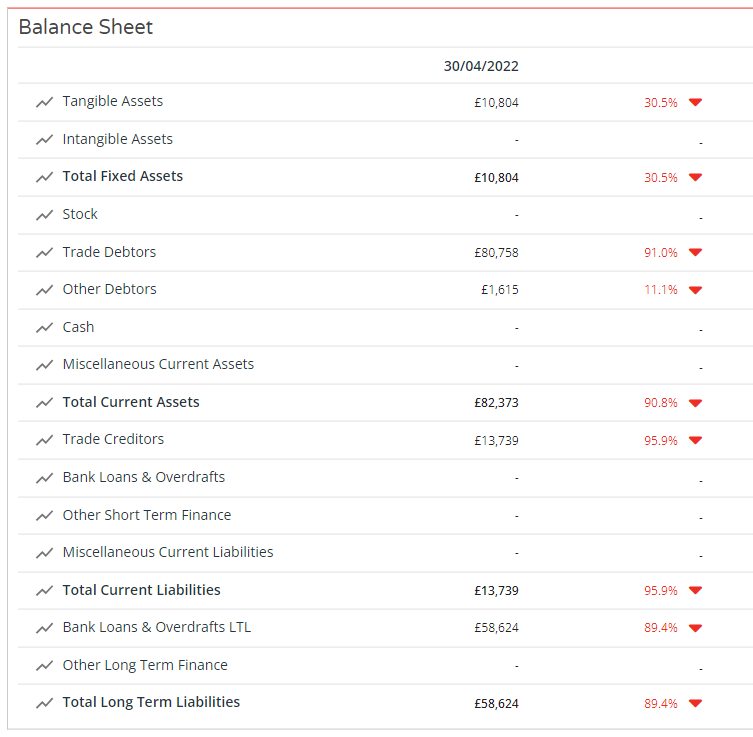

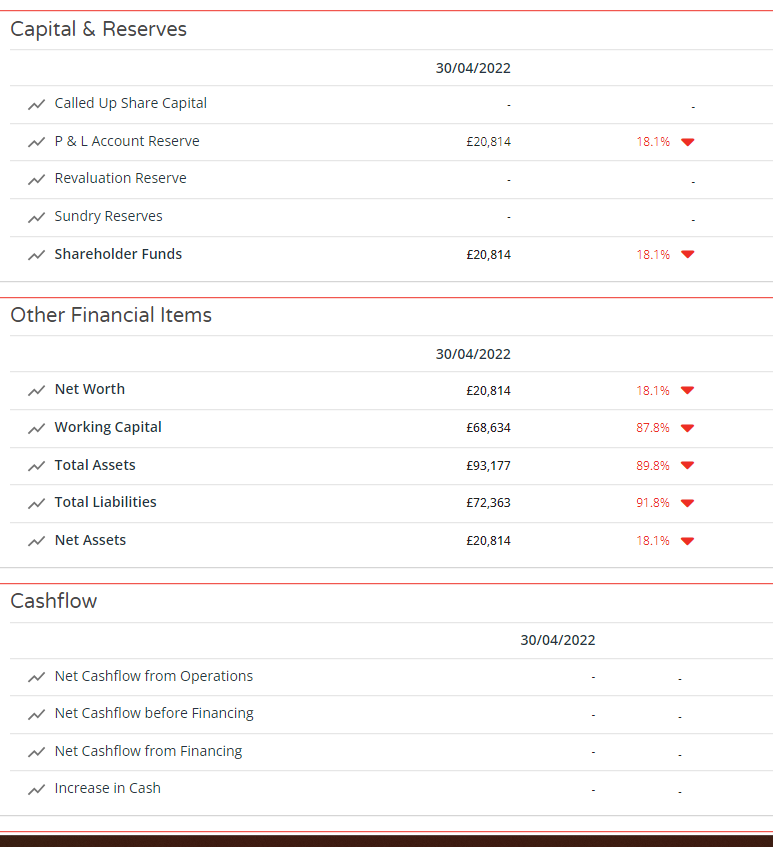

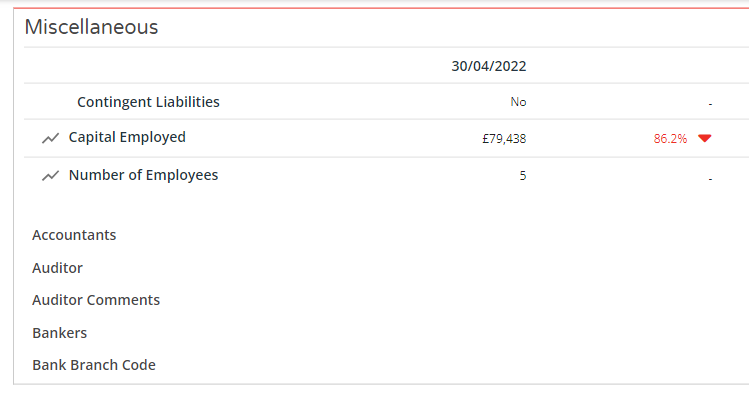

Financials

This shows all the submitted financial information from companies house in a company return.

Acid Ratio

Also known as Liquidity/Acid Test is a measure if in the short term can a company meet its debts. A positive ratio is generally preferred as it shows they have more liquidity in their accounts vs low debt.

Event History

This shows a customers score history is either increasing or decreasing. You are looking for stability or an increasing score. A decreasing score is usually a negative factor.

Negative Information

This usually includes CCJ's. CCJ's are when a customer has been taken to court over a debt and lost. Any CCJ's are bad news.

No Comments