| **Field** | **Example** |

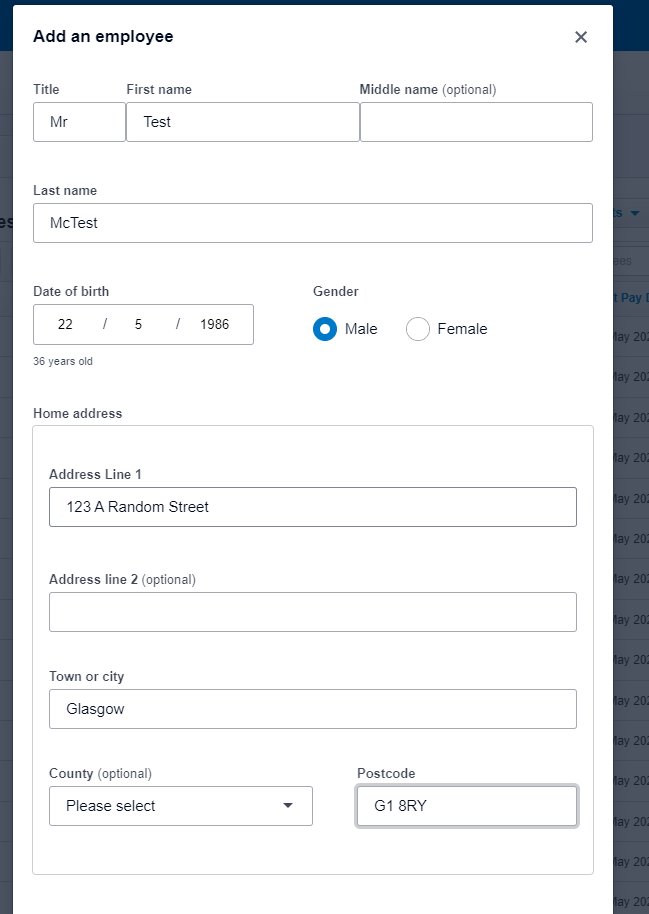

| **Title** | Mr |

| **First Name** | Joe |

| **Surname (Last Name)** | Bloggs |

| **Personal Email Address** | joe.bloggs@gmail.com |

| **Date of Birth** | 22/05/1986 |

| **National Insurance Number** | AB123456C |

| **Gender** | Male |

| **Home Address** | 123 A Random Street, Glasgow, G1 8RY. Scotland |

| **Off-Payroll Worker** | No\* |

| **Start Date** | 01/05/2022 |

| **Contract Type** | Hourly or Salaried |

| **Pay Rate** | Salaried Example - £24,000 Per Year Hourly Example - £10.50 Per Hour |

| **Number of Hours Per Week** | 40 Hours |

| **Pay Frequency** | Weekly, Monthly, Fortnightly etc (default is Monthly) |

| **Has Private Pension?** | No\*\* |

| **Job Title** | Professional Guy |

| **Phone Number** | 07712341234 |

| **Emergency Contact** | **Name:** Jane Blogs **Phone Number:** 01236 712345 |

| **P45 If the employee has one** | No |

| **Does Employee have a student loan to pay off?** | If yes... **Plan Type, Start date and End date are required** |

**\***An **Off-Payroll Worker** is usually a **contractor paid by invoice**, we do not use payroll to manage contractors.

**\*\*Private Pensions -** By default our system use Nest as our Pension supplier, employees have the option of us paying directly into their own private pension. This will usually be described in the employees contract.

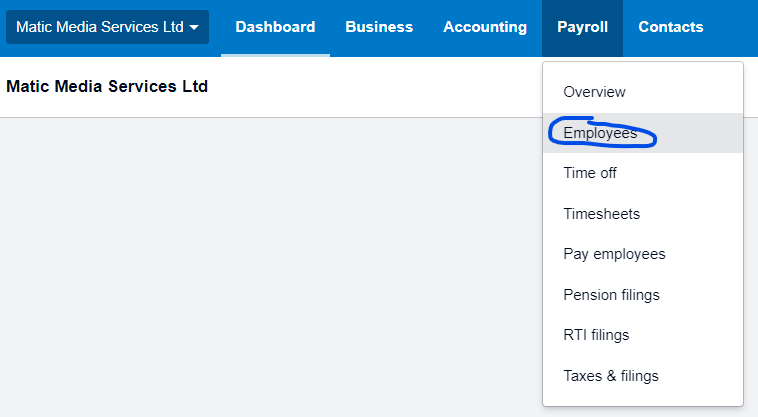

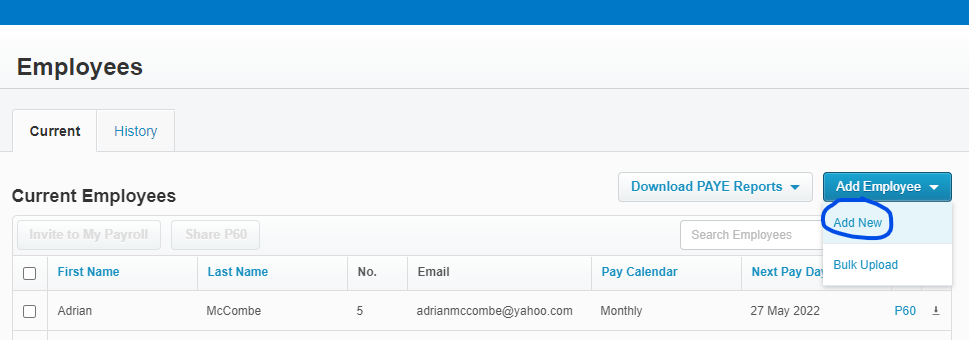

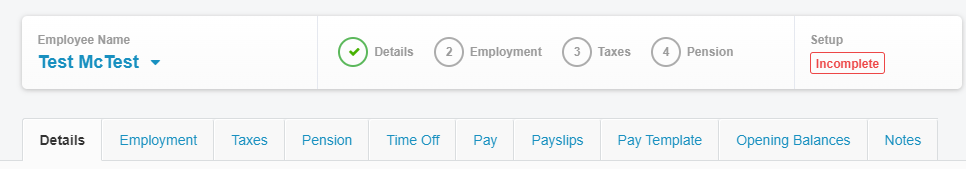

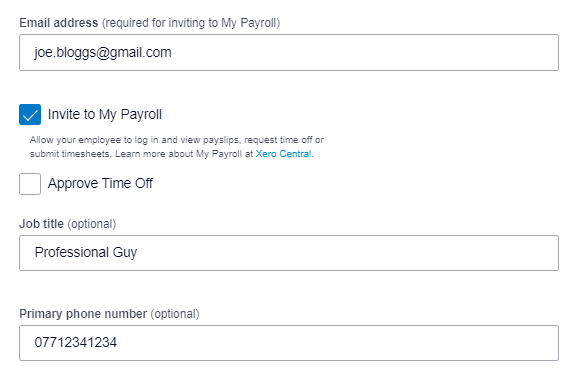

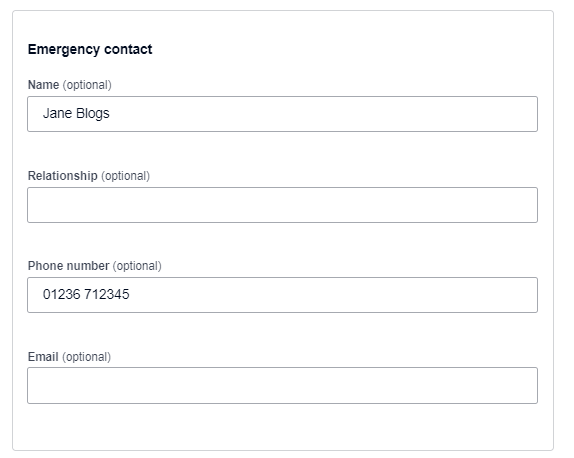

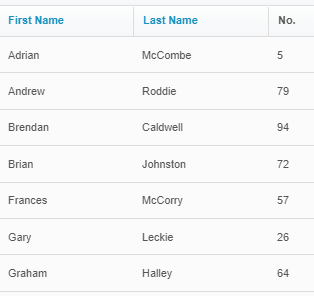

## Process for Adding a New Employee ### Employee Details Screen 1. From the top navigation menu go to "Payroll > Employees" [](https://manual.maticmedia.co.uk/uploads/images/gallery/2022-05/image-1653401360381.png) 2. From the Employees Screen click "Add Employee > Add New" [](https://manual.maticmedia.co.uk/uploads/images/gallery/2022-05/image-1653401411330.png) 3. Fill in the Start Form from the collected information in the [Required Information step](#bkmrk-required-information) [](https://manual.maticmedia.co.uk/uploads/images/gallery/2022-05/image-1653401115169.png) 4. You will then be show an incomplete Employee [](https://manual.maticmedia.co.uk/uploads/images/gallery/2022-05/image-1653401720363.png) 5. On the employees Details screen 1. Enter the employee's Personal Email Address 2. Check the box for Invite to My Payroll 3. Enter the Employee's Job Title 4. Enter the Employees Phone Number [](https://manual.maticmedia.co.uk/uploads/images/gallery/2022-05/image-1653402022945.png) 6. Click on Add Emergency Contact [](https://manual.maticmedia.co.uk/uploads/images/gallery/2022-05/image-1653402044241.png) 1. Enter the emergency contact information (Name and Phone Number is enough) [](https://manual.maticmedia.co.uk/uploads/images/gallery/2022-05/image-1653402089704.png) 7. Click "Save & Next" [](https://manual.maticmedia.co.uk/uploads/images/gallery/2022-05/image-1653402112779.png) #### Employee Employee Screen Steps... 1. [Enter the Fields as below...](#bkmrk-fields) 2. [Enter the Salary and Wages](#bkmrk-salary-and-wages) 3. Click "Save and Next" [](https://manual.maticmedia.co.uk/uploads/images/gallery/2022-05/image-1653402112779.png) ##### Fields| **Employee Number** | This needs to be a unique number, pick the next number from the Employees Screen e.g. in the example below it would be 95 [](https://manual.maticmedia.co.uk/uploads/images/gallery/2022-05/image-1653403166074.png) |

| **Employment Start Date** | The date the employee started. Fill this in from the details collected in [Required Information](#bkmrk-required-information) |

| **Payroll Calendar** | This is how often we pay the employee, as standard it is paid Monthly |

| **Paid Intermittently** | Their pay is intermittent e.g. long term sick or 0 hour contract |

| **Holiday Group** | Leave this as None |

| **Employee Group** | Leave this as None |

| **National Insurance Number** | Fill this in from the details collected in [Required Information](#bkmrk-required-information) |

| **NI Category** | This should be NI category A unless the employee has let us know otherwise |

There are two methods for setting up an employees Tax, with or without a **P45**

Steps... #### Employee has a P45| **Starter declaration** | a) First job in this tax year b) Currently only working in this job (not their first job in this tax year) c) They are working more than one job |

| **Tax Code** | Match tax code with p45 |

| **Previous taxable pay** | From the p45 copy over the previous taxable pay and previous tax paid (BOX 7 on P45) |

| **Starter declaration** | a) First job in this tax year b) Currently only working in this job (not their first job in this tax year) c) They are working more than one job |

| **Tax Code** | Let the default tax code entered automatically by xero do the work |

| **Student Load Type** | Collected in [required information](#bkmrk-required-information) |

| **Start date** | Collected in [required information](#bkmrk-required-information) |

| **End date** | Collected in [required information](#bkmrk-required-information) |

Employees are given the option to pay into the company pension scheme, our is run by Nest but if employees have a private pension they can pay directly into that.

##### If a employee has a private pension**Ask Robert**

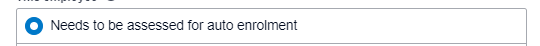

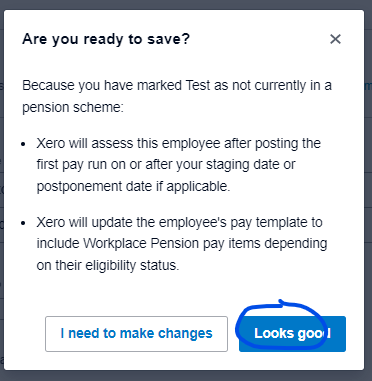

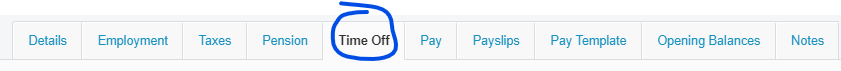

##### If an employee is using auto-enrolment (Nest) 1. Click "Needs to be assessed for auto enrolment" [](https://manual.maticmedia.co.uk/uploads/images/gallery/2022-05/image-1653405482201.png) 2. Click "Save" [](https://manual.maticmedia.co.uk/uploads/images/gallery/2022-05/image-1653405517842.png) 3. Click "Looks Good" [](https://manual.maticmedia.co.uk/uploads/images/gallery/2022-05/image-1653405622286.png) #### Set up Time Off (Holidays) On the time off screen [](https://manual.maticmedia.co.uk/uploads/images/gallery/2022-05/image-1653405569880.png)**For 2022 Only - You need to calculate the total allowance for the year and then deduct off the allowance between 01/01/2022 and 01/04/2022**

##### Calculate the number of holidays in hours an employee has - All employees are entitled to 5.6 weeks of holidays a year including bank holidays - In days this is 28 days - In hours this is 224 hours - Or 0.1076923076923077 hours per hour worked**OUR HOLIDAY YEAR RUNS JANUARY TO DECEMBER NOT APRIL TO APRIL**

##### To calculate the number of hours a new start has for a full year.224 hours - business holidays in hours = allowance

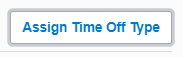

##### To calculate the number of hours a new start starting part way through a year Use the allowance calculator provided by uk gov - [Calculate holiday entitlement - GOV.UK (www.gov.uk)](https://www.gov.uk/calculate-your-holiday-entitlement) AMOUNT PROVIDED BY GOV WEBSITE - BUSINESS HOLIDAYS IN HOURS = ALLOWANCE e.g **Employee starts on 1st of May, works 40 hours per week** 152 Hours **How many company holidays are left between 1st of May and 31st December 2022?** You can view this on the holiday calendar here: [Matic Media Holiday Calendar](http://mail.maticmedia.co.uk:81/home/holidays@maticmedia.co.uk/Calendar.html?view=month&date=20220524) - June Jubliee Bank Holiday (2 days - 8 hours x 2 = 16 hours) - December 25th - 31th (5 days - 8 hours x 5 = 40 hours) Total business holidays - 56 hours **How many holidays left?** 152 hours - 56 hours = 96 hours ##### How to apply hours... 1. Click assign time off [](https://manual.maticmedia.co.uk/uploads/images/gallery/2022-05/image-1653406810970.png) 2. Fill in the form as below and enter in the calculated number of holidays. [](https://manual.maticmedia.co.uk/uploads/images/gallery/2022-05/image-1653406843075.png) # Making an Employee a Leaver**AN EMPLOYEE SHOULD ONLY BE MADE A LEAVER AFTER THEIR FINAL [PAY RUN](https://manual.maticmedia.co.uk/books/payroll/chapter/pay-run "Pay Run") IS COMPLETED.**

**LEAVER PAY RUNS SHOULD BE DOWN IN SEPARATE PAY RUNS**

**HOLIDAYS REMAINING CAN BE A NEGATIVE, IN THIS CASE THEY SHOULD BE A DEDUCTION - EXACTLY THE SAME PROCESS, EXCEPT NEGATIVE HOURS**

**FOR 2022 LEAVERS AN ADDITIONAL 55.3HOURS MUST BE DEDUCTED OFF THE ALLOWANCE**

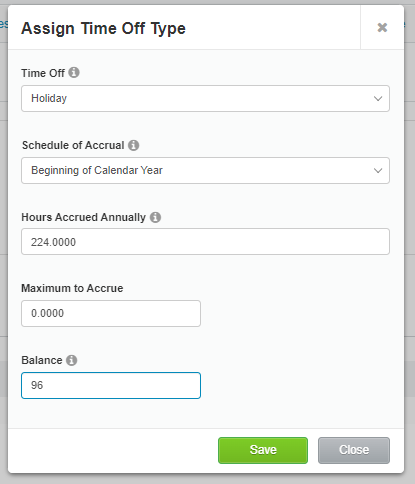

## Steps to ending an employee's employment in Xero... 1. [Calculate the number of holidays an Employee has left](#bkmrk-calculate-the-number-0) 2. Ask Richard or Robert about any outstanding deductions an employee has 3. Do a [Pay Run for only the leaver](https://manual.maticmedia.co.uk/books/payroll/chapter/pay-run "Pay Run") 4. When doing the Pay Run add the 1. [Holidays Left (or Deduct over holiday allocation)](https://manual.maticmedia.co.uk/books/payroll/page/adding-holidays "Adding Holidays") 2. [Any other deductions](https://manual.maticmedia.co.uk/books/payroll/page/adding-deductions "Adding Deductions") 5. End the employee's employment 6. Generate the employee's P45 ### Calculate the number of holidays an employee has left Steps... 1. [Use GOV website use the calculator to find out the number of holidays the employee is due for the period they have worked of the holiday year](#bkmrk-use-gov-website-use--0) 2. [Total the holidays an employee has used in the holiday year](#bkmrk-total-the-holidays-a) 3. Deduct the total holidays from the remaining holiday allowance #### Use GOV website use the calculator to find out the number of holidays the employee is due for the period they have worked of the holiday year Using the calculator at [Calculate holiday entitlement - GOV.UK (www.gov.uk)](https://www.gov.uk/calculate-your-holiday-entitlement) enter the following information - Year Start Date - **This is always the first of January** - Employee Start Date (if within this holiday year) - Employee Leave Date - Employee Hours Per Week - Employee Days Per Week The calculator will tell you the number of hours the employee is entitled to. #### Total the holidays an employee has used in the holiday year Total any holidays the employee has had in this from the entitled to calculation. You can get a total calculation from the employee's screen and the **"Time Off" section.** 1. Add up all the hours in the time off section up to the point of the employee's end date. 2. In the example below the employee has had **20 hours total paid Holiday (In this example the employee's last date is the 1st of June 2022)****Remember to add on business holidays to this amount, they are not automatically added to this list**

[](https://manual.maticmedia.co.uk/uploads/images/gallery/2022-05/image-1653421244661.png) #### Deduct the total holidays from the remaining holiday allowance**Equation to be used:** Total remaining holidays to be paid = Remaining allowance = holidays used

##### Example in use Leaver started in 2011, leaving on the 1st of June 2022.| **Leaver Start Date** | 01/02/2011 |

| **Leaver End Date** | 01/05/2022 |

| **Holiday Allowance (Using Calculator)** | 93.3 |

| **Holidays Allowance Used** | 20 |

| **Business Holidays Used** | 16 |

| **Total Allowance Used** | 36 |

| **Holidays Remaining** | 57.3 = round up to nearest hour = 58 |